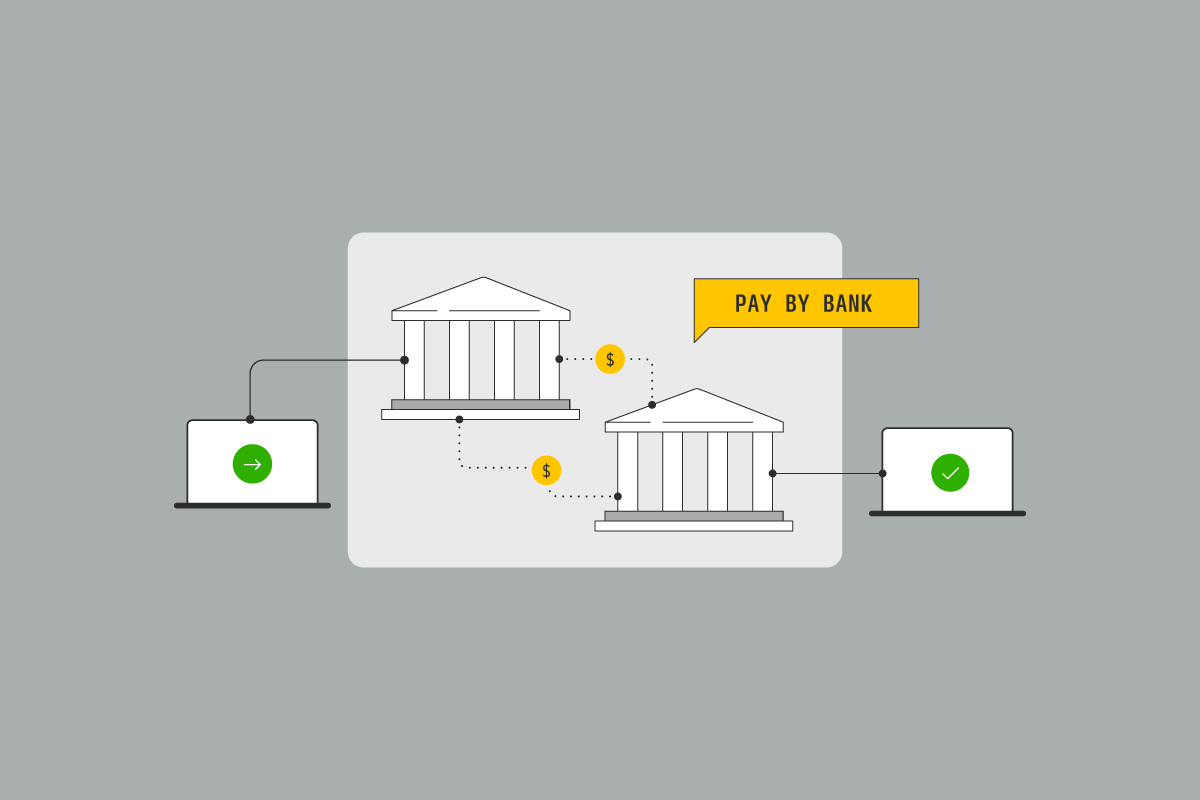

Nigeria’s digital payment ecosystem is at a crossroads. While digital payment adoption is growing, with over 60% of the population engaging in online transactions, many Nigerians still face persistent barriers: transaction failures, delays in receiving one-time passwords (OTPs), and security concerns such as fraud. These challenges starkly contrast Nigeria’s reputation as a fintech powerhouse in …

More-

How “Pay with Bank” will work with open banking in Nigeria

-

Are Mono and Stitch truly open banking?

Open banking. The buzzword that has everyone nodding in agreement, but if you stop the average person on the street—or even in the boardroom—they’d struggle to tell you what it really means. Is it APIs? Fancy fintech dashboards? Or is it just another Silicon Valley dream exported to Africa and rebranded for the local market? …

More -

What’s OCEN and could it work with open banking in Nigeria?

Imagine a world where access to credit isn’t just a privilege for the fortunate few but a foundational layer of everyday life—like clean water or electricity. Now, hold that thought and ask yourself: why is it that in a country with over 200 million people, borrowing money still feels like climbing a mountain while blindfolded? …

More -

The role of NIBSS in open banking

One could say NIBSS was built for this pivotal moment in Nigeria’s financial history. Back in 1993, the Central Bank of Nigeria and the Bankers’ Committee brought in NIBSS to solve a massive problem—Nigerian banks couldn’t talk to each other. Transferring money between banks was a nightmare. Each bank was in its silo, and that …

More -

How business owners can leverage open banking in Nigeria

Most business owners in Nigeria are sitting on opportunities they don’t even know exist. While everyone is busy talking about “scaling up” or finding the next big import deal, there’s a quiet revolution happening right under our noses—open banking. The funny thing is, the very people it could help the most are the ones who …

More -

What every Nigerian needs to know about data privacy in open banking

Data privacy in open banking isn’t the headline-grabbing attention in Nigeria. It’s not the celebrity scandal everyone talks about, and it’s certainly not what you’ll see trending on Twitter on a random Tuesday. But maybe it should be. Because right now, while we’re all focused on the newest loan app or the hottest fintech, our …

More -

Why Open Banking Nigeria built an open-source gateway for the industry

Discover how OBN’s open-source API gateway is simplifying financial data sharing, driving innovation, and opening doors for banks and fintechs to deliver better services while fostering financial inclusion.

More -

Important regulations for open banking in Nigeria

Let’s walk you through the specific open banking regulations in place, their implications, and how they ensure a secure environment for all stakeholders.

More -

How open banking will transform savings and investment in Nigeria

In a country where over 40% of the population lives below the poverty line, saving isn’t just a luxury; it’s a necessity. Whether it’s for emergencies, school fees, or starting a small business, saving gives people a safety net. But the reality is only about 32.5% of adults in Nigeria actively save, and even fewer …

More -

Critical stakeholders in the Nigerian open banking journey

Nigeria embarked on its Open Banking journey in 2017, spearheaded by a coalition of industry stakeholders advocating for greater innovation and inclusion. This mirrored the United Kingdom’s pioneering efforts under GDPR and the Second Payment Services Directive (PSD2), which sought to establish Open Banking. Additionally, the UK initially used Open Banking as a regulatory tool …

More