Nigeria’s digital payment ecosystem is at a crossroads. While digital payment adoption is growing, with over 60% of the population engaging in online transactions, many Nigerians still face persistent barriers: transaction failures, delays in receiving one-time passwords (OTPs), and security concerns such as fraud. These challenges starkly contrast Nigeria’s reputation as a fintech powerhouse in Africa, underscoring the urgent need for a more effective, secure payment solution.

Introducing Pay with Bank, a payment system that taps into the power of Open Banking to overcome the limitations of traditional card payments. By linking consumers’ bank accounts directly to merchant platforms, it eliminates the need for cards, offering a faster, less friction, and more secure way to pay. Pay with Bank is set to transform Nigeria’s online payment scene, providing a smooth, secure, and inclusive option that could simplify transactions for millions.

The persistent challenges of card payments in Nigeria

While card payments dominate the online transaction landscape globally and in Nigeria, they are not without significant drawbacks. Despite the widespread use of card schemes such as Verve, Mastercard, Visa, and the recent addition of AfriGo, users often encounter obstacles that hinder their ability to make smooth, efficient, and secure payments. These challenges frustrate consumers and hinder the broader adoption of digital payments. Here are the main persistent issues:

Lost or damaged cards

Physical debit and credit cards are prone to wear and tear, especially in Nigeria’s climate, where cards are frequently exposed to harsh conditions. From being tucked in wallets or purses to frequent use at ATMs, cards often become damaged or illegible over time. When this happens, users are unable to read the card details, such as the card number or expiry date, making online payments impossible. The inconvenience of dealing with lost or worn-out cards is a common pain point for many Nigerians, often leading to transaction delays or cancellations.

Activation hassles

For many banks in Nigeria, activating a card for use in digital transactions is a key prerequisite for online payments. While this process is intended to enhance security, it can be cumbersome and time-consuming. Some customers forget to activate their cards or face difficulties navigating the process. Others find themselves unable to activate their cards due to connectivity issues or technical failures with the bank’s system. This added layer of complexity makes card payments inconvenient, particularly when users need to make urgent transactions.

Delayed or failed OTP deliveries

One of the major security features in card payments is the One-Time Password (OTP), sent to a user’s phone or email to authorize transactions. However, OTPs can sometimes be delayed or, in some cases, not received at all. This issue, caused by network failures, SIM card problems, or delays in the bank’s messaging system, results in failed payments and frustrated customers. Transaction failures due to OTP delays are a frequent source of annoyance, especially when customers are trying to complete purchases or payments during peak times.

Fraud risks

Card fraud is a well-known issue in Nigeria. With the proliferation of data breaches and phishing scams, card details are vulnerable to unauthorized access. Cybercriminals can easily obtain or generate fake card numbers through various fraudulent means, leading to financial losses for users. Many Nigerians hesitate to make online purchases using cards due to the heightened fear of fraud. As a result, even with secure online payment systems, consumers often remain wary of sharing their card details online, undermining their confidence in digital payments.

Manual data entry

Entering card details — 16-digit card numbers, expiration dates, and security codes — can be tedious and prone to errors. Typos are common, and entering such lengthy strings of data can lead to failed payments or missed transactions. Furthermore, this manual entry process is time-consuming, discouraging people from making frequent online payments. Many users opt to avoid online payments altogether due to the complexity of the process, which limits the growth of e-commerce and digital services in Nigeria.

Expiry and renewal challenges

Another problem with card payments is the expiration of cards. When a card expires, the user must physically go to the bank to request a new one. This process can take several days, during which time the customer may be unable to make online payments. The need to go through this renewal procedure disrupts users’ daily routines, especially when they rely on their cards for regular transactions. Additionally, the need for physical card replacement places a barrier to entry for individuals who may not have easy access to banks or may be unaware of the renewal process.

Moreover, high transaction fees — up to 1.5% per transaction — make the card payment system costly and inefficient for merchants and consumers. The need for a solution is undeniable.

What is “Pay with Bank”?

“Pay with Bank” simplifies and enhances the online payment experience. It enables users to make direct payments from their bank accounts, bypassing the need for credit or debit cards. The method builds upon the principles of Open Banking, which allows banks to securely share customer account data with authorized third parties, enabling new financial products and services.

At its core, Pay with Bank eliminates many issues associated with traditional card payments, such as lost or damaged cards, forgotten PINs, or the need to repeatedly enter long card numbers. Instead, users only need to provide their bank account details, making the process faster and easier.

This payment method is already widely used in regions like Brazil and the EU, where users can pay directly from their bank accounts using basic account numbers and shortcodes. In Nigeria, where people are familiar with their bank account numbers and often store them on their phones for quick access, Pay with Bank is poised to offer a similarly smooth experience. This approach offers several key benefits:

Cost-effectiveness

Traditional card payments often involve high processing fees, which can burden merchants and consumers. Pay with Bank significantly reduces transaction costs by bypassing the card networks, offering a more efficient payment system.

Convenience

Instead of searching for your credit card or typing in a long series of numbers, you only need to enter your bank account number and select your bank. This simplification makes payments quicker and less prone to error.

Enhanced security

One significant benefit of Pay with Bank is the enhanced security it provides. Rather than sharing sensitive card information, users link their bank account details to a secure payment platform. With tokenization, this information is stored in an encrypted format, ensuring it can only be accessed and used with the user’s consent.

Broader accessibility

With over 133 million active bank accounts in Nigeria, Pay with Bank offers digital payment options for those who may not have access to a debit or credit card or prefer not to use them online. This includes a large segment of the population who may have reservations about card payments due to fraud or data breach concerns.

User control

Pay with Bank gives users greater control over their payments. Through the Open Banking framework, users can set parameters for each transaction, such as limits on the amount of money that can be transferred, the duration of authorization, or the frequency of transactions. This consent-based model enhances transparency and reduces the risk of unauthorized payments.

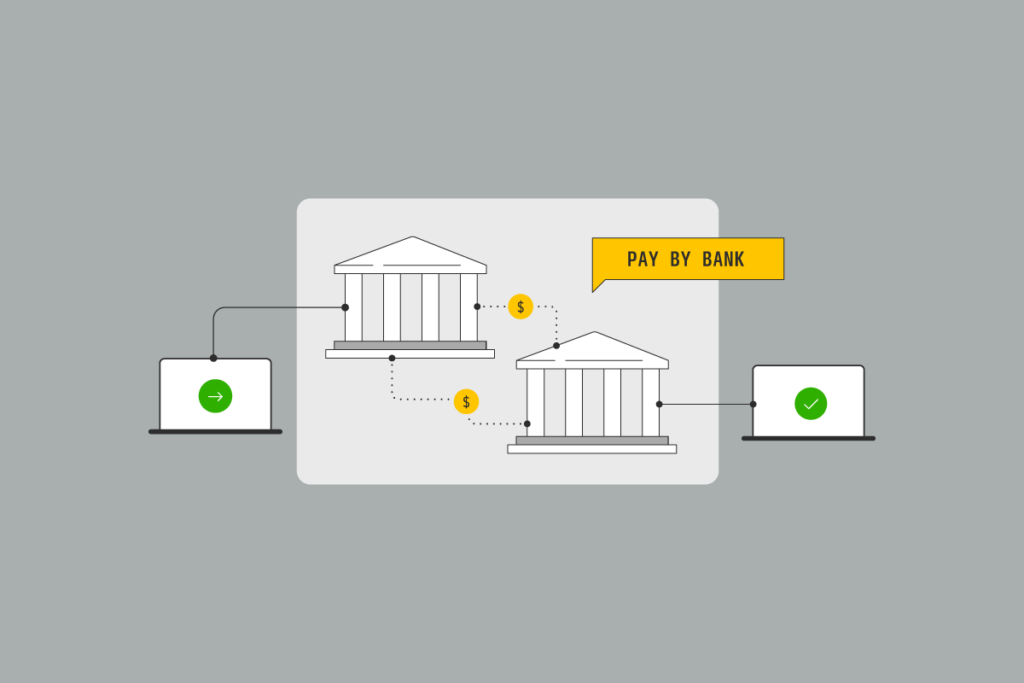

How it works with Open Banking

Open banking is the cornerstone that enables Pay with Bank to transform how payments are made in Nigeria. By using open banking’s secure data-sharing system, Pay with Bank makes payments faster, safer, and more flexible. Here’s a quick walkthrough of how it works.

Tokenization

Open banking allows users to tokenize their bank account details, linking their accounts to secure payment platforms. This process ensures that sensitive information is never directly shared with third-party platforms. Instead, a token — a unique digital identifier for the account — is used to authorize payments. This is essential for maintaining security and privacy while making payments. Users can set specific consent parameters, such as transaction limits, payment frequency, and validity, empowering them with control over their financial interactions.

Push and pull transactions

Traditional bank transfers are typically “push” transactions, where the payer (user) initiates the payment by transferring funds to the merchant. Pay with Bank introduces a “pull” transaction model, which allows merchants to securely debit authorized amounts directly from a customer’s account, provided the customer has given prior consent. This method reduces transaction times and simplifies the payment process, providing a smoother experience for merchants and consumers.

Direct connections

One of the most significant advantages of Pay with Bank over traditional card payments is the direct connection between fintech providers, merchants, and banks. Unlike card-based transactions that require multiple intermediaries, Pay with Bank transactions use Open Banking’s secure APIs to connect directly to the bank’s infrastructure. This eliminates the need for third-party processors and reduces both the cost and time associated with completing transactions, improving the overall efficiency of the payment process.

Increased security

With the standardization provided by Open Banking, Pay with Bank transactions are protected by robust security protocols. Every transaction is authorized through user consent, ensuring that funds are only debited when the customer has explicitly agreed. Additionally, Open Banking’s secure data-sharing framework means customers’ sensitive information is not shared with merchants or payment processors, significantly reducing the risk of fraud and unauthorized transactions.

A new chapter in digital payments for Nigerians

Pay with Bank is more than just another way to pay; it’s a fresh approach that addresses the daily frustrations of using cards online. By tapping into Open Banking, it eliminates unnecessary intermediaries, eases transactions, and delivers a user-controlled experience that prioritizes both security and simplicity. This isn’t a one-size-fits-all approach — it’s a recalibration of how Nigerians interact with their finances online, tackling longstanding pain points like OTP delays, card fraud, and transaction costs. As it integrates into the broader ecosystem, Pay with Bank could redefine how trust and convenience are embedded in digital payments, laying the groundwork for a more inclusive financial future.